Running a business can be an incredibly rewarding endeavor, but it also comes with its fair share of risks and uncertainties. The key to protecting your business and ensuring its long-term success lies in understanding the power of business insurance. In this guide, we will explore the importance of business insurance, providing you with valuable insights into the different types of coverage available. Whether you’re a general contractor, own a hotel, or simply operate a small business, this article will serve as your comprehensive resource for navigating the world of business insurance in Utah. So, let’s delve into the intricacies of business insurance and discover how it can shield your business from unforeseen challenges and potential financial loss.

Importance of Business Insurance

Business insurance is a critical safeguard for any company, providing valuable protection against a range of potential risks and uncertainties. Whether you are a small business owner or a large corporation, having the right business insurance coverage can make all the difference in ensuring the long-term success and stability of your enterprise.

First and foremost, business insurance provides financial protection in the event of unexpected events or accidents. From property damage to liability claims, having appropriate coverage can help mitigate potential losses and minimize the impact on your bottom line. Without insurance, the costs of such incidents can be devastating, potentially leading to bankruptcy or closure.

Additionally, business insurance is essential for establishing credibility and trust with clients and investors. Many customers and partners require proof of insurance before entering into any kind of business agreement. By demonstrating that you have the necessary coverage, you are instilling confidence and demonstrating your commitment to professionalism and responsible business practices.

Moreover, business insurance can help protect your employees and provide peace of mind for both workers and employers. With appropriate coverage, you can ensure that your employees are protected in the event of accidents, injuries, or illness that may occur while on the job. This not only helps with employee morale but also helps to mitigate potential legal costs that may arise from workplace incidents.

In summary, business insurance is a vital tool for protecting your company and its assets. Whether you are a general contractor in Utah or own a hotel, having the right insurance coverage will shield your business from potential financial disaster, enhance your reputation, and provide a safe and secure working environment for your employees. Don’t underestimate the power of business insurance – it’s an investment that can truly pay off in the long run.

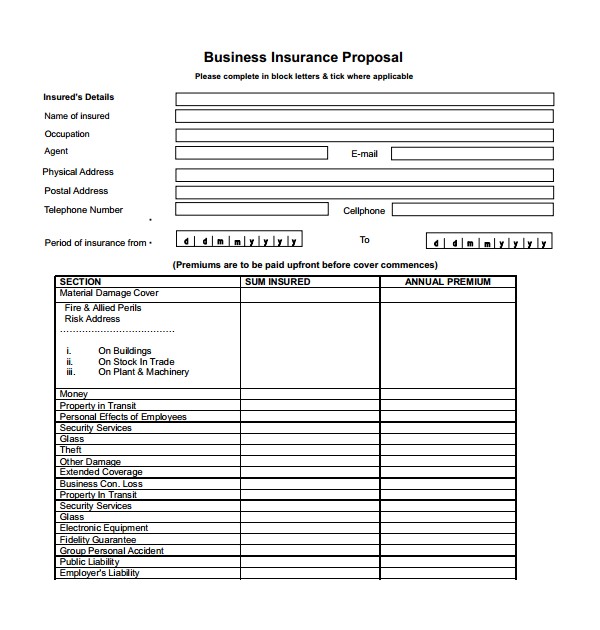

Types of Business Insurance

Liability Insurance: An essential form of insurance for any business is liability insurance. This type of coverage protects a business from legal claims and financial losses in the event that it causes harm or damage to someone else. For example, if a customer slips and falls in your store, liability insurance can help cover the medical expenses and any potential lawsuits that may arise from the incident.

Property Insurance: Property insurance is crucial for businesses that own physical assets such as buildings, equipment, and inventory. This type of insurance provides financial protection in the event of damage, theft, or loss of these assets. Whether it’s a fire that damages your office space or a burglary that results in stolen equipment, property insurance can help cover the costs of repairs or replacement.

Professional Liability Insurance: Also known as errors and omissions insurance, professional liability insurance is necessary for businesses that provide professional advice or services. It safeguards against claims of negligence, errors, or failure to deliver promised results. This type of coverage is particularly important for professionals such as consultants, accountants, and attorneys, as it helps protect them from potential lawsuits that may arise from dissatisfied clients.

Med Spa Insurance

Remember, while these three types of insurance are crucial, it is important to assess your specific business needs and evaluate other potential insurance coverages that may be relevant to your industry. By adequately protecting your business with the right insurance policies, you can shield yourself from unexpected financial burdens and minimize risks.

Choosing the Right Insurance for Your Business

When it comes to protecting your business, choosing the right insurance is crucial. With a wide range of options available, it’s important to find coverage that aligns with the unique needs and risks of your specific industry. Whether you operate a small shop or a large corporation, finding the right insurance policy is a must.

One important consideration is business insurance in Utah. Utah-specific policies take into account the unique regulations and requirements of the state, ensuring that your business is adequately protected against potential risks and liabilities. From property damage to lawsuits, having the right coverage in place can provide you with peace of mind.

For industries such as general contracting, specialized insurance coverage is essential. An insurance guide for general contractors can provide valuable insights and recommendations on the types of coverage needed in this field. This may include protection against injuries on construction sites, damage to property, or liability claims arising from construction projects. By following the guidelines set out in a comprehensive insurance guide, you can make informed decisions to safeguard your contracting business.

Another industry that requires specific insurance coverage is the hotel industry. Hotels face unique risks, including potential property damage, guest injuries, and liability claims related to accidents or other incidents on the premises. Having insurance coverage tailored to the needs of hotels is crucial in ensuring all these risks are mitigated effectively. By referring to an insurance guide for hotels, you can navigate through the different options available and identify the policies that best match your hotel’s requirements.

Choosing the right insurance for your business is not a one-size-fits-all endeavor. By understanding the specific risks and requirements of your industry, as well as consulting relevant insurance guides, you can make informed decisions and protect your business effectively. Remember, insurance is an investment in safeguarding your business’s future, so take the time to choose wisely.