The evolution of automated teller machines, commonly known as ATMs, has transformed the way we interact with our finances. Once limited to basic cash withdrawals, today’s ATMs offer a plethora of services that enhance convenience and efficiency in our daily lives. From depositing checks to transferring funds, these machines have become ubiquitous in urban and rural landscapes alike, making banking accessible to everyone at any time.

One notable player in this landscape is ATMgeorgia, an innovative ATM company dedicated to providing comprehensive solutions for businesses and consumers. They not only process cash loads but also specialize in the installation and de-installation of ATMs, ensuring that establishments can offer banking services tailored to their specific needs. As we delve into the journey of ATMs, it is clear that these machines have continuously adapted to meet the growing demands of a fast-paced society.

The Rise of ATMs in Banking

The Automated Teller Machine, or ATM, revolutionized the way we access our finances. Introduced in the late 1960s, ATMs provided customers with a new level of convenience by allowing them to withdraw cash and check balances without needing to visit a bank branch during business hours. This innovation shifted the traditional banking landscape, making banking services available around the clock. The initial designs were basic, but the appeal of quick and easy access to cash spurred rapid adoption worldwide.

As technology advanced, so did the functionality of ATMs. Banks began integrating features such as electronic deposits, fund transfers, and even bill payments into these machines, enhancing their utility for everyday consumers. With the rise of digital banking, ATMs became more sophisticated, adapting to the growing demand for seamless banking experiences. Companies like ATMgeorgia played a significant role in this evolution by processing cash loads and installing or de-installing these crucial machines, ensuring their availability in various locations.

Today, ATMs are ubiquitous, present in various environments from shopping centers to universities, serving the convenience of diverse customers. They have become an integral part of the banking system, allowing users to manage their finances efficiently. The continuous enhancements to ATM technology reflect the ongoing commitment by financial institutions and service providers to meet the evolving needs of consumers, solidifying the ATM’s role in everyday banking activities.

Introducing ATMgeorgia: A Game Changer

ATMgeorgia is revolutionizing the way we interact with automated teller machines by providing exceptional services that cater to both business and consumer needs. As a leading ATM company, it stands out in the industry with its commitment to reliability and innovation. By processing cash loads efficiently and offering comprehensive installation and de-installation services, ATMgeorgia ensures that ATMs operate smoothly in various locations.

The company’s expertise in cash management is paired with a deep understanding of customer demands. ATMgeorgia not only focuses on the installation of machines but also takes care of their maintenance, enabling businesses to provide uninterrupted access to cash for their customers. This level of service is essential in today’s fast-paced world, where convenience is paramount, and any downtime can lead to lost opportunities and frustrated clients.

ATMgeorgia’s dedication to enhancing the ATM experience does not go unnoticed. By combining quality equipment with top-notch service, it has positioned itself as a trusted partner for businesses looking to enhance their financial service offerings. Whether through strategic placement of ATMs or ensuring they are always stocked with cash, ATMgeorgia is at the forefront of transforming how we utilize these machines in our daily lives.

Innovations in Cash Load Processing

In recent years, the cash load processing for ATMs has seen significant advancements, enhancing the efficiency and security of transactions. ATMgeorgia has been at the forefront of these innovations, providing state-of-the-art solutions that simplify the cash loading process. With the latest technology, cash can be securely transported and loaded into machines, reducing the time and labor traditionally required for these operations.

One of the notable improvements is the integration of smart technology that allows for real-time monitoring of cash levels in ATMs. This proactive approach enables operators to anticipate cash needs and streamline the supply chain, minimizing the risk of outages. ATMgeorgia’s commitment to innovation has led to the development of services that can predict cash requirements based on usage patterns, ensuring ATMs are always adequately stocked.

Moreover, the use of advanced security measures during the cash loading process has become crucial. ATMgeorgia employs high-tech surveillance and tracking systems to ensure that cash remains secure from the moment it leaves the vault to its final destination inside the ATM. This enhanced focus on safety not only increases trust among customers but also bolsters the overall integrity of ATM operations in our daily lives.

The Future of ATMs in Daily Transactions

As we look ahead, the role of ATMs in daily transactions is set to evolve significantly. With the increasing reliance on digital payments and online banking, ATMs will need to adapt to maintain their relevance. Future innovations may include more advanced features that cater to the changing needs of users, such as biometric authentication and enhanced security measures. These updates will not only streamline the withdrawal process but also provide users with a sense of safety and convenience.

ATMgeorgia

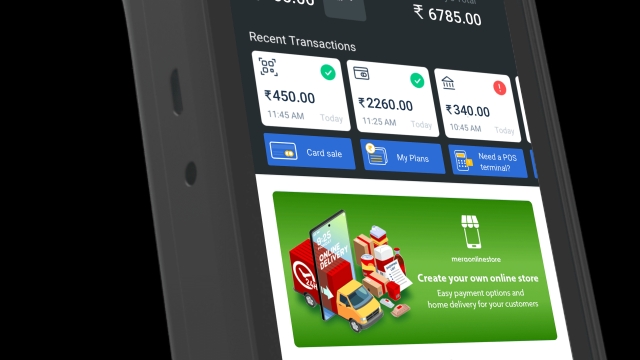

Moreover, the integration of ATMs with other financial services will enhance their functionality. Users may soon find ATMs equipped to handle more than just cash transactions, offering services such as bill payment, instant loan applications, and even cryptocurrency transactions. This shift towards multifunctionality could transform ATMs into comprehensive financial hubs, making them invaluable in our daily financial activities.

Companies like ATMgeorgia, which focus on processing cash loads and installing or de-installing machines, will play a crucial role in this transformation. Their expertise in adapting to market trends will help guide the development of ATMs to meet future demands. As the landscape of banking and finance continues to change, collaboration between technology providers and ATM companies will be essential in ensuring that these machines remain a key component of our everyday financial experiences.